High net worth

individuals

High net worth individuals are typically individuals with a net worth of at least $1 million, excluding the value of their primary residence. These individuals often have complex financial needs and require sophisticated investment products to meet their goals. Here's how Geniego can be useful for high net worth individuals:

Pricing Transparency: Fixed coupon notes can be complex financial instruments, and pricing can be opaque. Geniego can provide high net worth individuals with a transparent and easy-to-use tool for pricing fixed coupon notes, which can help them make informed investment decisions.

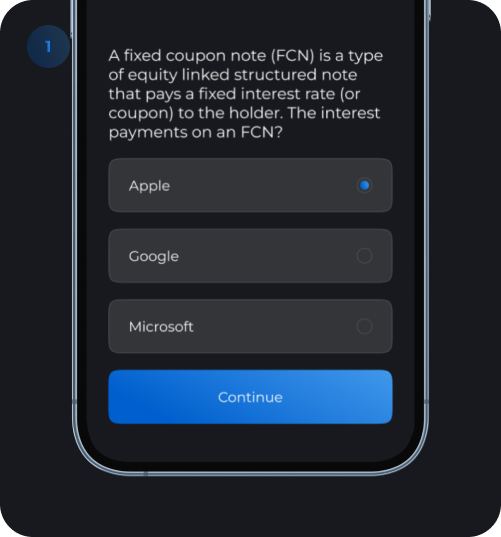

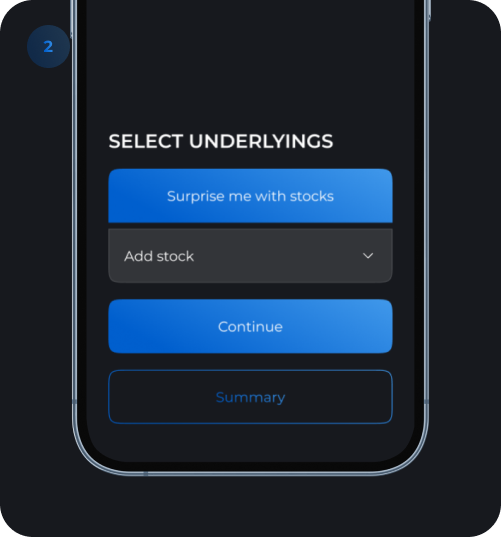

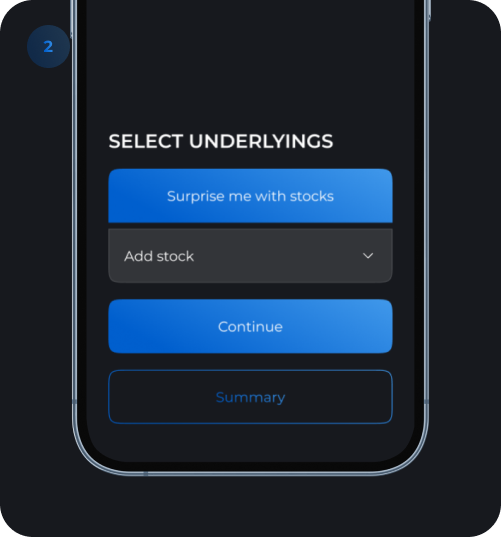

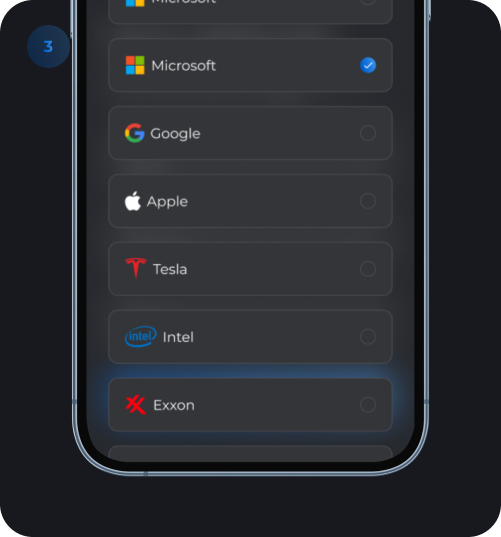

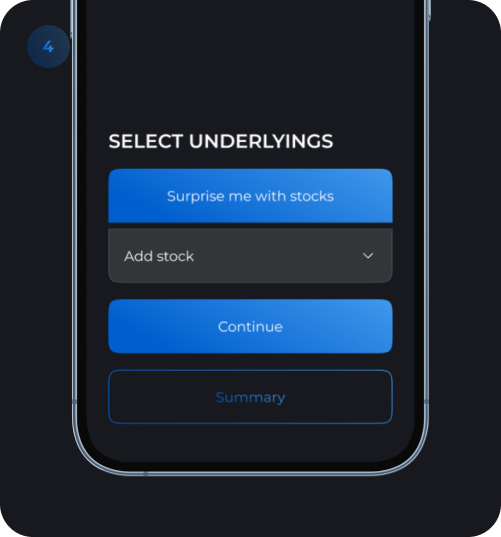

Structuring tool: HNIs can use geniego to structure an FCN with underlyings and terms that they like. Once a structure is finalized, this can be executed through the usual channels.

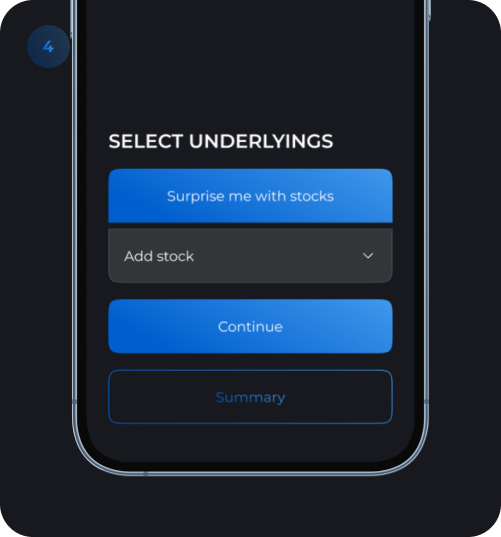

Investor Education: Fixed coupon notes can be risky, and it's important for high net worth individuals to understand the risks involved. Geniego can provide educational content on the risks and benefits of fixed coupon notes, which can help high net worth individuals make more informed investment decisions.

Analytics and Performance Tracking: High net worth individuals often have complex investment portfolios and need to track the performance of their investments closely. Geniego can provide analytics and performance tracking tools that can help high net worth individuals make more informed investment decisions and manage their portfolios more effectively.

Family Offices

Family offices are private wealth management firms that manage the assets of high net worth families. They typically provide a range of services, including investment management, tax and estate planning, and philanthropic advising. There are SIngle Family Offices handling wealth of a single client and there are multi family offices handling wealth of multiple families. Here's how Geniego can be useful for Family Offices:

Independent Valuation: Fixed coupon notes can be complex financial instruments, and pricing can be opaque. Geniego can provide Family Offices with a transparent and easy-to-use tool for pricing fixed coupon notes, which can help them make informed investment decisions. This will help family offices to showcase their commitment to the fiduciary duty towards end client by providing an independent valuation rather than relying on valuations from the product distributor.

Faster turn around/increased efficiency: Family Offices can use geniego to structure an FCN with underlyings and terms that they like. Once a structure is finalized, this can be executed through the usual channels. This will increase the turn around time and the efficiency of your relationship managers. Geniego only takes few seconds to price an FCN compaired to current half an hour turn-around time for FCN pricing requests send to Private Banks. Family offices can use your website to analyze different fixed coupon notes and select those that align with their risk tolerance and investment objectives.

Skills building: Geniego provides curated training content on FCNs. Completing this training and obtaining a geniego certificate will help your product teams and relationship managers differentiate themselves in the market place. Your team will be able to provide better service to clients based on this knowledge.

Analytics and Performance Tracking: Geniego can provide analytics and performance tracking tools that can help family offices make more informed investment decisions and manage their portfolios more effectively. Geniego provides analytics tools that allow family offices to track the performance of their investments in fixed coupon notes. This can include hisorical performance, as well as risk analytics. These analytics can be used to inform investment decisions and help family offices achieve their financial goals.

Security

companies

Securities companies play a vital role in the financial markets by providing investors with access to a wide range of investment products and services. Fixed coupon notes are a popular investment product among securities companies' clients, as they provide a fixed income stream and relatively low risk compared to other investment products. Here's how Geniego can be useful for high net worth individuals:

Independent Valuation: Fixed coupon notes can be complex financial instruments, and pricing can be opaque. Geniego can provide Family Offices with a transparent and easy-to-use tool for pricing fixed coupon notes, which can help them make informed investment decisions. This will help family offices to showcase their commitment to the fiduciary duty towards end client by providing an independent valuation rather than relying on valuations from the product distributor.

Skills building: Geniego provides curated training content on FCNs. Completing this training and obtaining a geniego certificate will help your product teams and relationship managers differentiate themselves in the market place. Your team will be able to provide better service to clients based on this knowledge.

Private Banks

Private banks are an essential part of the financial ecosystem, catering to high-net-worth individuals and providing them with personalized financial advice and investment services. Fixed coupon notes are a popular investment product among private banking clients. Here's how Geniego can be useful for high net worth individuals:

Regulatory Compliance: Fixed coupon notes can be complex financial instruments, and pricing can be opaque. Geniego can provide Private Banks with a transparent and easy-to-use tool for pricing fixed coupon notes, which can help them make informed investment decisions. This will help family offices to showcase their commitment to the fiduciary duty towards end client by providing an independent valuation rather than relying on valuations from the product distributor. Providing Independent Valuations is a regulatory requirement for Private Banks in many jurisdictions.

Skills building: Geniego provides curated training content on FCNs. Completing this training and obtaining a geniego certificate will help your product teams and relationship managers differentiate themselves in the market place. Your team will be able to provide better service to clients based on this knowledge. Such trainings can be used to meet the continous professional developement requirements for representatives.